One of the questions most often asked of us by sellers or buyers is when will the market turn around? While none of us pretend to have a crystal ball or a magic hat, it is easy for us to see that the Real Estate market in SE-WI will not be changing all that much in the next several months at least, due to a high inventory of homes and tight lending standards.

The market peaked in the Spring of 2005. The years prior to 2005 were marked by a run up in home values like we had never seen before. There were years during this time where property values increased by over 10% year to year. These values were not sustainable as incomes failed to keep pace.

In a survey of Realtors by Homegain in March, 2009 showed that 45% of homeowners think their homes should be listed 10 to 20 percent higher than what their Realtors recommend. Nearly 20 percent of homeowners think that their homes are worth 20 percent higher than their agents recommended listing price. Home buyers are experiencing a similar disconnect on price. According to the Realtors surveyed by HomeGain, only 18 percent of their home buying clients think homes are fairly priced.

This survey underscores that while homesellers may be aware of falling home prices around the country, many believe that the slide doesn't apply to their homes. Many sellers have decided to take their homes off the market or not list at all because they want to wait "till the market comes back". There is a belief by many sellers that the market is going to come back very soon. Unfortunately many sellers are putting off their plans to move on with their life hoping that the market will make a dramatic "V shaped" recovery which has never happened before.

A fascinating thing about the decision process is a sellers unwillingness to part with the lost equity on their current home, even though they will be turning around and purchasing another home under the same conditions. Furthermore, everyone accepts losses in other assets such as the stock market, collectibles and cars but most people find it hard to take a loss in the value of real estate. We constantly witness sellers getting hung up on getting X amount out of their home that they continue to "feed" even a vacant property by paying each month taxes, mortgage, maintenance, etc. You can now find 100s of properties that have been on the market for over 2 years, many of them vacant (not foreclosures).

Most economists predict that once we do finally hit bottom we will only see a more historical norm of 2-3% yearly appreciation on our homes. Do the math - with this kind of reality check it is very easy to see why it is going to take a long time to get to the levels were at prior to the Real Estate correction.

Some food for thought. As of this writing interest rates are outstanding under 5%. If you have wanted to sell your home for whatever reason and are not because you don't want to lose the equity you once had then you could be making a huge mistake. Interest rates are at a once in a life time level. When the economy does finally improve interest rates this low will not last.

It could be 5-7 years or longer before we get back to the levels of 2005. What are the chances that interest rates will be where they are now when that finally happens? When your home finally does get back to 2005 levels so will all the other homes in the area.

Thursday, April 23, 2009

Thursday, April 16, 2009

Flat Fee is out. Reasons why:

Recently Homeowners Concept switched from being a flat fee company to just charging 1.5% of sales price. Our fee was around 1.5% anyhow as it was a tiered fee structure, so there is very little impact on any of our clients. The reason behind the switch though, was the fact that we needed to disassociate ourselves from the other flat fee companies which have popped up in the last few years and are now showing histories of low success rates while charging the sellers a hefty upfront fee of around $500 (see post of 2/20/09). Most of these outfits are doing just MLS data entry, and they could care less whether the home sells. Thousands of sellers have fallen victim to paying the hundreds of dollars upfront, wasting months or years on the market and having to turn to another broker (ourselves included) to eventually sell.

Homeowners Concept on the other hand is a full service real estate company which offers more marketing, more experience for less commission due to innovative and efficient systems and has been around since 1984. We have also earned the Accredited Business BBB award - one of only two large companies to have this! We have a vested interest in making sure the home gets maximum exposure (percentage wise we spend the most amount of money advertising properties of any company). We actually work very hard for the money.

So many of these flat fee outfits have come to the market the last few years (as of this writing we can find at least 11 in SE-WI) because it is such easy money for little work with no pressure to sell the homes. The proliferation of these is reminiscent of the online FSBO websites that were started as internet became mainstream. Hundreds of them have shut down in recent years as consumers wised up that spending hundreds of dollars upfront to be on "somebody's" website that received virtually no hits, was indeed useless. We feel the same fate awaits the MLS only/limited service companies.

Homeowners Concept on the other hand is a full service real estate company which offers more marketing, more experience for less commission due to innovative and efficient systems and has been around since 1984. We have also earned the Accredited Business BBB award - one of only two large companies to have this! We have a vested interest in making sure the home gets maximum exposure (percentage wise we spend the most amount of money advertising properties of any company). We actually work very hard for the money.

So many of these flat fee outfits have come to the market the last few years (as of this writing we can find at least 11 in SE-WI) because it is such easy money for little work with no pressure to sell the homes. The proliferation of these is reminiscent of the online FSBO websites that were started as internet became mainstream. Hundreds of them have shut down in recent years as consumers wised up that spending hundreds of dollars upfront to be on "somebody's" website that received virtually no hits, was indeed useless. We feel the same fate awaits the MLS only/limited service companies.

Tuesday, April 7, 2009

Extremely High Success Rate.

We occasionally get this question asked: How many of your listings do you sell? Answer: All properties, IF sellers allow us to sell their property. You see, sellers control the price of the home on the market. Most sellers are in tune with the current market and listen to our advice on initial pricing, presentation, feedback and any price adjustment that may be necessary. With our expertise and the massive exposure we offer (see 30 points of marketing), all bases are covered. Nevertheless, a small minority of sellers defy the market's call and refuse to make any adjustment to the price or presentation of the home.

This small number of sellers who refuse to face reality sometimes migrate to a high commission agency under the perception that by paying much more in commission a buyer will come along and pay "their price". Reality though is, that buyers DO NOT care how much commission one pays. One can see this by the previous post that sellers find this out the hard way, wasting many more months on the market, then reducing (sometimes multiple times) and paying a high commission at the end. Not a smart move by any means.

In previous years sellers could ask more than the market because as prices rose those sellers would eventually get "their price". Nowadays though the market is stagnant, if a seller wants a higher price than the market analysis by one of our expert agents suggests, or showings and feedback from buyers indicates too high of a price, the property sits. All real estate companies face the same problem with sellers in denial (see article Milwaukee Journal Home section of 3/15/09 ).

With our very low commission structure, sellers have a clear advantage over sellers with a high commission broker because they can afford to lower the price if they want to sell. For an average metro-Milwaukee home of $209,000 the savings between a 6% and our 1.5% commission amounts to $9,400. So if a buyer is looking at two identical properties one at $209,000 the other at $199,600 you know which one is going to get more showings and eventually an Offer. Of course there is rarely identical properties due to so many variables (location, condition, decorating, etc). This is the area where our expertise comes into play. Given the exposure and expertise we offer, there is no way a property cannot sell under our program. Hence the statement above.

This small number of sellers who refuse to face reality sometimes migrate to a high commission agency under the perception that by paying much more in commission a buyer will come along and pay "their price". Reality though is, that buyers DO NOT care how much commission one pays. One can see this by the previous post that sellers find this out the hard way, wasting many more months on the market, then reducing (sometimes multiple times) and paying a high commission at the end. Not a smart move by any means.

In previous years sellers could ask more than the market because as prices rose those sellers would eventually get "their price". Nowadays though the market is stagnant, if a seller wants a higher price than the market analysis by one of our expert agents suggests, or showings and feedback from buyers indicates too high of a price, the property sits. All real estate companies face the same problem with sellers in denial (see article Milwaukee Journal Home section of 3/15/09 ).

With our very low commission structure, sellers have a clear advantage over sellers with a high commission broker because they can afford to lower the price if they want to sell. For an average metro-Milwaukee home of $209,000 the savings between a 6% and our 1.5% commission amounts to $9,400. So if a buyer is looking at two identical properties one at $209,000 the other at $199,600 you know which one is going to get more showings and eventually an Offer. Of course there is rarely identical properties due to so many variables (location, condition, decorating, etc). This is the area where our expertise comes into play. Given the exposure and expertise we offer, there is no way a property cannot sell under our program. Hence the statement above.

Wednesday, April 1, 2009

Some Sellers Pay Much More Commission, Unnecessarily

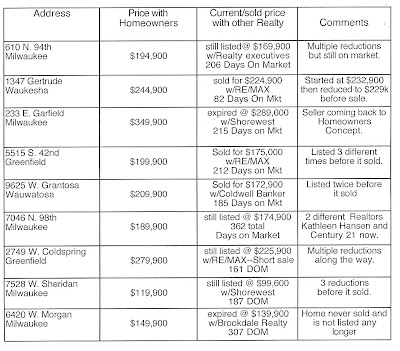

Paying a high commission of 5, 6 or 7% gives no advantage whatsoever to a seller as the table indicates.

Paying a high commission of 5, 6 or 7% gives no advantage whatsoever to a seller as the table indicates.Homeowners Concept offers massive marketing for properties (see 30 points of marketing) and only employs highly skilled agents that guarantee successful and smooth transactions. Despite all the benefits Homeowners Concept brings to the table there are rare occasions where a seller expires unsold (refused to adjust price to market conditions) and subsequently lists with a high commission broker.

This is a list of sellers and their properties that have left Homeowners Concept in last year and the price that they are currently on the market or sold for with another realty paying FAR MORE in commissions and getting less marketing for the homes (As of 4/1/09).

Evidently a few sellers have the perception that paying more will get the home sold and sold at the price they want. The fact is that buyers could care less how much commission one is paying. Actually by having to pay much less commission a seller could get the home sold by offering a better price to the buyer (see blog post of 2/26/09 for an actual case).

This is a list of sellers and their properties that have left Homeowners Concept in last year and the price that they are currently on the market or sold for with another realty paying FAR MORE in commissions and getting less marketing for the homes (As of 4/1/09).

Evidently a few sellers have the perception that paying more will get the home sold and sold at the price they want. The fact is that buyers could care less how much commission one is paying. Actually by having to pay much less commission a seller could get the home sold by offering a better price to the buyer (see blog post of 2/26/09 for an actual case).

Subscribe to:

Posts (Atom)