Friday, December 25, 2009

Wednesday, December 16, 2009

WE'RE NOT A FLAT FEE COMPANY AND DO NOT CHARGE AN UPFRONT FEE!

Homeowners Concept on the other hand is a FULL service company which offers more marketing and more experience for less commission due to innovative and efficient systems and has been around since 1984. We have a vested interest in making sure the home gets maximum exposure (percentage wise we spend the most amount of money advertising properties of any company) and bringing expertise to get the home sold. That entails advice on staging, getting feedback from buyers, properly negotiating the contract and subsequent issues with inspection, financing, closing, occupancy, etc. We have also earned an A+ BBB rating - one of only two large companies to have this! We actually work very hard for the money and we DO want the homes to sell.

The flat fee outfits are usually one or two person shops because it is such easy money for little work with NO pressure to sell the homes. The proliferation of these is reminiscent of the online FSBO websites that were started as internet became mainstream. Hundreds of them have shut down in recent years as consumers wised up that spending hundreds of dollars upfront to be on "somebody's" website that received virtually no hits, was indeed useless. We feel the same fate awaits the MLS only/limited service companies.

Thursday, December 3, 2009

Putting off buying could be a mistake.

As some of you know, the Federal Reserve has been buying mortgage obligations for the past few months which has artificially kept rates low. The Fed has recently indicated that this program will be coming to an end. Consequently, expect the rates to slowly creep up to a level of around 6%.

Another reason not to delay buying is the anticipated demand for houses always goes up after the holidays. As demand increases early in 2010 and this time accelerates as we get closer to the April 30th deadline, buyers can lose the home of their dreams or pay more for it than today.

Monday, November 23, 2009

Paying 6%? You're also paying up to $595 extra at closing.

Thursday, November 12, 2009

PAYING A HIGHER COMMISSION WAS A COMPLETE WASTE OF MONEY.

This property at 1813 N. 56th in Washington Heights was listed with Homeowners Concept until 9/30/08 when it expired at $249,900. Our very successful agent tried repeatedly to get seller to pay attention to the declining market, to no avail (yes, despite our 25 yr expertise in the market, some sellers have a tough time coming to grips with the current market). After a couple of months off market she listed with a First Weber agent who had sold only one other property in the last 12 months, MLS #1057682 (there are some sellers that for some reason believe that another less successful, less seasoned broker will do a better job...?). Seller proceeded to do a number of price reductions all the way down to $214,900 by late September, 2009.

At that price, a Homeowners Concept Realtor who was working with a buyer showed the property and got an Accepted Offer for $208,000. Eventually Homeowners Concept sold the property and seller paid a much higher commission to us via the "co-broke" of 2.4% (this actually came out of the listing broker's 6% commission). That is about $1,872 more the seller had to pay to us plus an additional $7,488 to the listing broker for a total of $9,360 more than our 1.5% commission.

The irony of this very real transaction is that by backing away from Homeowners Concept's overwhelming and successful record of 25 years, this seller found out that the market controls the price the home sells for. The seller only has control of how much commission one pays. Had the seller stayed with Homeowners Concept this seller would have walked away with $9,360 more at closing. Buyer would have paid the same amount for the home regardless!

Thursday, November 5, 2009

Which seller are you?

Getting your home sold in SE-WI right now, is not as tough as you might think despite the market. The key is understanding a few things about yourself and how you approach the market that determines if and how quickly you sell.

What Home Buyers Want

Right now, there are roughly half the number of buyers in the market as we would normally see. As a general rule, they are conservative and concerned due to the state of the economy and tough lending requirements. They are looking for value. Ultimately, they are going to buy the home that is the best value on the day they make their purchase decision… Wouldn’t you if you were buying today?

Understanding The Housing Competition

Knowing that buyers are looking for value, another key factor if you want to sell a home is knowing who your true competition really is. For you to determine “good value,” you have to know what to compare with. This takes working with a real estate agent that understands the market better than the others. Choosing your initial market position is perhaps the most important factor when deciding to put your home on the market.

Your Motivation To Sell A Home.

So you know what buyers want and you understand your competition and how to value your home, the next and final step is to understand your current situation. Are you motivated enough to sell your home? Here’s a simple test:

Pick which of the below choices best describes you. Think seriously before you decide, as this will help you greatly.

- The Casual Seller - The casual seller says things like “We are not in a hurry,” or “We don’t want to give it away.” You can expect this person to say “We will sell if we can get $X ….”

- The Serious Seller - The serious seller says things like “I understand the market and I’m willing to sell my home for what I’m seeing out there.” This seller is ready to sell at “perceived market value” and they expect to price their home with the competition to get it sold.

- The Very Serious Seller - The very serious seller must sell now. They are willing to create a perception of value and entice buyers to select their home before all others.

Who will sell their home in the next few months?

So, what kind of a seller are you?

If you answered the above question as honestly as you could, you need to know that the casual seller is not going to sell their home in today’s market. There are just way too many homes for sale and the casual sellers are doing themselves and the very serious sellers a dis-service by adding to the inventory.

The market will eventually recover and there will again be great times to sell, but today’s buyer pool is looking for value. Even the serious seller is most likely not going to sell their home. With over 11 months of supply in SE-WI plus new short sales and foreclosures entering the market, only the very serious sellers have the best chance of being successful over the next 12 months. Luckily with our very low commission of 1.5% a seller listing with Homeowners Concept has quite a few thousands of dollars in savings to play with. A serious seller can take the savings and deduct it from the list price making their home much more attractive to buyers.

Monday, October 26, 2009

THE SAVINGS IN COMMISSIONS IS YOUR BONUS

Over the years we have developed a program that we can guarantee as the most efficient and effective way for selling homes. We have done this by providing more in marketing properties (having the most widely distributed homes magazine and a great website, among others) and having highly skilled, full time, long term agents who are truly dedicated to real estate. You see, the traditional high commission model of just hiring agents regardless whether the business is there or not saddles the system with mediocre agents who spend most of their time competing with each other offering the same thing and charging 5-6% commissions (see post of 8/26/09). There are way too many agents for the amount of sales and one can understand why the average agent does only a few deals a year and has just a few years in business. We on the other hand, limit the hiring to just the best in the business so our Realtors do a lot of sales saving you money from excessive commissions.

When you work with Homeowners Concept, you work with some of the most successful and most active agents in the area. Our Realtors know what’s going on in the market right now because they spend all of their time serving clients: touring homes, writing offers and closing deals. The savings in commissions again is your bonus.

Wednesday, October 21, 2009

The futile way of selling FSBO

This year alone we have tracked FSBOs in Wauwatosa (one of the healthiest in sales in the metro area). So far only one home out of 14 has sold this way. All others have turned to Realtors and 2 w/Homeowners Concept - one of which has sold, the other is pending.

Ordinarily, FSBO is the cheapest way to sell most of the time BUT that is only if you sell (although there have been cases where FSBOs have spent far more than our fee, mainly on attorney costs). Factoring in the extremely low probability of selling as a FSBO the cost of selling is substantially higher. It is the time one loses trying as a FSBO (usually 8-9 weeks) that damages the home's chance of getting sold at its highest price plus the money a FSBO spends on marketing. It is the buyers' reluctance to enter negotiations with the seller directly and spend hundreds if not thousands of dollars in legal fees plus maneuver through the transaction on their own that dooms the FSBOs. One of the fallacies sellers have is that a buyer will use "their" lawyer to do the buyer contract, counters, amendments, etc. That is extremely rare and besides, attorneys list their homes with Realtors at the same rate as any other profession (they know better). Over the years we have had hundreds of sellers who were trying completely on their own, then turn to our company and within a number of days to a few weeks got an accepted offer as a result of having someone the buyers could turn to.

Every year, $100s of millions of dollars are wasted by sellers trying to sell as a FSBO before they turn their home over to a Realtor to eventually sell it. If sellers knew all the facts, they would never resort to sell a property as a FSBO not as long as companies like ours are around.

Friday, October 9, 2009

Mortgage information you should be aware of.

The first was an FHA loan for a Wauwatosa home that Bank of America will not approve due to issues on the condition report which the buyer was accepting. Our preferred mortgage Banker Netcentral Mortgage placed the loan with a lender that does not require the condition report.

The second buyer was not getting approved for a Waukesha condo at Westbury Bank due to an association assessment. Again Netcentral Mortgage was able to place the loan with an underwriter that accepted the assessment restriction.

We suggest to buyers to avoid hassles, delays and even rejection of their loan by using a reputable mortgage banker. Mortgage bankers work with multiple lenders and know which underwriter will approve what. Furthermore, a mortgage bankers oftentimes have better rates or closings costs as different banks compete for loans. Netcentral Mortgage has beat or reduced closing costs for many buyers over the years.

Friday, September 18, 2009

A recent testimonial letter says it all

When we decided to sell our house in this current uncertain housing market we knew we were taking a risk, however, after our first meeting with Mary Skanavis from Homeowners Concept we knew we were going to have a knowledgeable and experienced professional by our side.

From the beginning Mary gave us straight-forward facts about our home sale. Unlike some of her competitors, she wasn’t telling us what we wanted to hear; she gave us a clear understanding of what our house was worth and what we could get for it. Together we came up with a “game plan” for how we were going to tackle our home sale. We really appreciated this type of approach because it left no mystery to how we were going to handle things going forward.

Like a good coach, Mary had almost daily correspondence with us informing us how showings went, how other houses in the market were doing and advice on how we could improve the success of selling our own home. Through that dedication we were able to sell our house remarkably fast and we sacrificed very little in the process. I cannot stress enough how thorough and involved Mary was, especially with answering all of our questions.

When it came time to buying our new house the decision to use Mary as our buying agent was an easy one. We ended up buying the house of our dreams and she negotiated the price saving us a substantial amount of money.

Working with Mary goes way beyond her expertise in the real estate industry. You can easily tell she enjoys her job and the challenges that come with it. She is very encouraging and charismatic and I would encourage anyone to work with her for buying or selling a home and the savings in commissions is a bonus.

Lisa and Mike G.

Sold in Wauwatosa/Bought in Pewaukee Using Homeowners Concept

Tuesday, September 15, 2009

Tax Credit Deadline is Approaching

On average, first-time buyers search for 12 weeks to find a home, while closing can take between 30 to 60 days depending on the lender or issues with the property, appraisal, etc. So, it is going to be a challenge for the buyers who are just beginning the process. Smart buyers though, can make extensive use of our website to narrow down their choices, work with one of our extremely experienced real estate Professionals and use our preferred lender Netcentral Mortgage so that they can make sure the purchase closes on time.

Wednesday, September 9, 2009

The Rent to Own program.

Thursday, September 3, 2009

What's keeping a lid on real estate prices?

Part of the reason prices have dropped and continue to stay low is due to a very high number of foreclosures. What is interesting though, according to a report led by economists from Northwestern University and University of Chicago confirming that people are walking away from their homes even if they can afford the monthly payments and it's happening on a grand scale.

In a study of more than 1,000 American households, the report concludes that more than a quarter of existing mortgage defaults are "strategic" -- done by those who can afford their monthly mortgage payments, but choose to default anyway.

A main factor in strategic defaulting is the extent a home is underwater, or worth less than what's owed on the mortgage. Have a look:

Amount Underwater | Percentage of Sample Declaring Intention to Default |

|---|---|

$50,000 | 9.38% |

$100,000 | 25.81% |

$200,000 | 41.23% |

$300,000 | 44.65% |

The report also found the propensity to walk away within a specific ZIP code fed on itself, which the researchers attributed to "a contagion effect that reduces the social stigma associated with default as defaults become more common." In other words, "Hey, if my neighbor's doing it, I might as well, too". This is happening far more in CA, NV, FL, AZ than in WI but it is happening nevertheless. As long as this phenomenon is going on and the high inventory of homes for sale, it is difficult to imagine a return to the bubble prices (years 2003-2005) any time soon.

Tuesday, August 18, 2009

Proper Pricing is Key to Selling.

Supply And Demand Dictate Home Values

We must never forget that real estate is a commodity and as such the laws of economics apply. Many of us think of our home as a unique place on this world, and while we are living there, it really is. But once we decide to sell it, our home becomes a house, a commodity that must be sold or traded in a market filled with competition. When supply outpaces demand, values fall. When demand exceeds supply, prices rise. We typically see a balanced market when inventory is 5-6 months. Anything less than that is a sellers’ market, and of course greater is a buyers’ market.

With about 11 months of supply of homes (was 3-4 months in 2004), we are clearly in a buyers’ market. The inventory has been very slowly coming down in the last few months with some sellers taking their home off the market until conditions improve and the $8,000 buyer credit contributing to the small decline.

Avoid The Biggest Mistake That Home Sellers Make

The biggest mistake I see from people who want to sell a home comes in both good and bad markets. They price their home too high (because they do not want to “leave anything on the table”). While this appears to make sense, it actually works against them as studies have found that the “freshest” homes on the market sell for a higher amount.

In an upwards moving market, a home that is priced too high will eventually sell when the market “catches up” with the higher value the seller demands. On the other hand in a declining market of the past couple of years, a higher price makes the home completely unsaleable as prices for comparable homes keep dropping.

Chasing The Market Is The Biggest Mistake A Seller Can Make

We refer to the actions of a seller who prices the home too high in a declining market as “chasing the market.” In this type of market as prices erode this seller has to keep reducing but never enough to undercut the competition (similarly priced homes which are SELLING) are bigger or nicer. What is truly tragic for this seller is that the home, in order to sell, has to get to a price much lower than it would have sold for, at the start of the marketing period.

How To Price A Home To Sell

This is a tough real estate market and roughly only half the homes that are offered for sale are going to sell over the next 12 months (based on data from the last 12 months)! If you do not need to sell your home, help everybody out (including yourself) and take your home off the market. But if you do need to sell, work with a real estate company such as Homeowners Concept that has real estate Professionals with vast knowledge in proper pricing, staging, negotiations, closing and offers extensive marketing. This is critical. Pricing your home correctly at the start, plus marketing it in key distribution channels will allow you to be part of the 1 in 2 happy home sellers that actually sell their home. Of course saving thousands off a 6% commission is nice too.

Wednesday, August 12, 2009

Tips to make sure your home does NOT sell.

Many articles and web sites exist that give sellers tips on selling their home. With thousands of properties in SE-WI on the market for over a year now I thought it was appropriate to put forth a list of 5 major tips to make sure your home fails to sell.

GO AT IT ALONE. This one is a no-brainer and I wrote about being FSBO in the previous post. Despite the great odds some people still try this route wasting money and time. Interestingly though the vast majority of these FSBOs will gladly pay a broker a commission (a cobroke) if they bring the buyer which is more than our 1.5% commission. Amazing!

USE A FLAT FEE BROKER. This is another avenue of selling with very low odds of whereby sellers pay up to $550 UPFRONT. The post of 3/25/09 really explains why the reputation of “list them and forget them” exists in the industry. Most of these outfits are doing just MLS data entry, and they could care less whether the home sells. Thousands of sellers have fallen victim to paying the hundreds of dollars upfront, wasting months or years on the market and having to turn to another broker or Homeowners Concept to eventually sell.

CASUALLY CHOOSE YOUR AGENT/REAL ESTATE COMPANY. The third biggest mistake out there is thinking that all real estate companies (and all real estate agents) are alike. Huge mistake. The fact is, real estate is an industry that is easy to enter and many people do so every year. In fact, the National Association of REALTORS® once published a report showing that 9 out of 10 people who get into real estate are out of the business within two years. Of all the major real estate companies in Metro Milwaukee we are the only one with the least amount of turnover. By far!

Selling a home is typically a very important, and costly event for most people. It involves their most expensive asset, so it always blows my mind when sellers pick their friend who “also does real estate.” Think about it, in every profession you have the “best in the business,” and then you have everybody else. Why trust this most precious asset to somebody who cannot deliver the very best for you? How can anybody who does real estate part-time and for a just a few years compete with those of us who do it full time and are veterans in the business? Also lets not forget that those same friends and relatives who happen to be agents still sock you with a 6% commission.

PRICE YOUR HOME TOO HIGH. Up until the 2005 peak in sales, a common method for marketing a home was to put a high price on it and then “let people bring you offers.” This made great sense, as you know everybody wants a deal, so you might as well build in some wiggle room. Another reason that this method was not so bad is that real estate always appreciated! No matter what price you put on the home, eventually the market would catch up to it and you would be able to sell your home. But not now. Prices are dropping. If you are overpriced today, the market is not catching up, it is leaving you behind.

IGNORE BUYER FEEDBACK. f you listen really closely, the market will tell you everything you need to know. First of all, when a great agent lists your home (which all of he or she will tell you on how best to position and price the home to attract an offer. Also a great agent will also get good feedback from the buyers that view your home. How does the home show? How does it compare to other similarly priced homes? So the key to not selling your home is to either not ask the questions, or at least ignore the answers.

Selling a home is not rocket science, paying attention to the above tips and using a company such as Homeowners Concept where an expert Realtor costs much less can aid tremendously.

Wednesday, August 5, 2009

Why selling For Sale By Owner is a losing game.

The very reason Homeowners Concept even exists today is because our founder walked away from buying a For Sale By Owner (FSBO) property in 1984 and in the process realized that many other buyers probably do the same and bypass the FSBO route. An extensive research of 100 FSBOs from 6 months earlier validated the theory and Homeowners Concept was born as the missing link between FSBO and paying a hefty 6% commission.

In essence, many sellers think that if they just stick a sign in the lawn and have an attorney to handle the paperwork, they are set. This assumption is far from reality as buyers do not use the sellers' attorney. Buyers have to retain their own lawyer at a substantial upfront expense without even knowing that they will get the house. Buyers still have to navigate everything on their own including issues with inspection, financing, appraisal, etc. No wonder then that buyers shy away from FSBOs unless the property is one heck of a deal. With odds of FSBO success this low one can see why Homeowners Concept has grown and flourished over the past 25 years assisting the wise sellers who are looking to save the high commission AND have an expert Realtor handle the sale.

Wednesday, July 29, 2009

British are upset paying even 3% commissions!!

Another reason is that many sellers cannot break away from the "obligation" to list with a high commission agent because he or she is a relative or "friend" who still charges 5 or 6% commission and in many cases is unskilled or part time in real estate. This compromises the saleability of the property and prolongs the sale.

Lastly, the consumer in this country has long felt rich and confident in the economic future that paying more for many things was part showing off and part keeping up with the "Joneses". Nevertheless, with the economic downturn of late many people are reassessing this desire to overspend for products and services. In other words, the American consumer is becoming more savvy. Maybe in the not too distant future ALL sellers will be paying reasonable commissions that wise Homeowners Concept sellers currently pay.

Tuesday, July 21, 2009

Paying 6% AND giving it away?

There is that persona that agents are like used car salesmen. Before I go further I want to say that I'm sure that there are a great deal of honest and ethical used-car salesmen but I use that industry because...well...you know exactly why. I must also state that for the most part, agents are ethical and look out for their clients, the seller. The bar is definitely being raised thanks in part to a much more savvy and demanding consumer. That said, it only takes one bad apple to spoil the bunch and oh boy are there some apples out there that are just rotten to the core. The following example is precisely why some members of the public continue to distrust our profession.

There is that persona that agents are like used car salesmen. Before I go further I want to say that I'm sure that there are a great deal of honest and ethical used-car salesmen but I use that industry because...well...you know exactly why. I must also state that for the most part, agents are ethical and look out for their clients, the seller. The bar is definitely being raised thanks in part to a much more savvy and demanding consumer. That said, it only takes one bad apple to spoil the bunch and oh boy are there some apples out there that are just rotten to the core. The following example is precisely why some members of the public continue to distrust our profession.A relative told one of her neighbors about saving the high commission using Homeowners. Her neighbor though was "obligated" to list it with the Realtor that sold it to her and had now become her "friend" (how can one be obligated to pay someone excessive commission?). The property at 7738 W. Mt Vernon (MLS # 1086757) is in a very desirable area of Milwaukee and has a Fair Market Value of $154,000. It has a large yard, updated KIT w/SS appliances included, rec rm and it is in immaculate condition. One could see this property going for more than FMV closer to $160k. YET it was listed by the friend agent for $139,900 and of course sold in the first couple of days. By comparison 206 N. 79th (MLS 1088899) which is very close to the subject property sold above assessment. The seller probably left $10-15,000 on the table PLUS paid a hefty commission. This could have been deliberate (just to get the listing sold and out the door) or could be a case of ineptness. The agent she listed with does just a few deals a year.

We occasionally do get sellers who unknowingly want to underprice their property but we take the Realtor ethics at heart and refuse to participate in this. Our agents' expertise which is much higher than the average high commission agent (see About Us) prevents us from making errors such as this. I cannot fathom any of our agents underpricing any of their clients much less their "friends".

Tuesday, July 14, 2009

June area homes sales up, but prices down

Milwaukee County has been a bright spot in the region for the number of home sales. June was the third consecutive month that Milwaukee County had higher homes sales than in 2008. Milwaukee County had 915 homes sold in June, up 10.8 percent compared to 2008, but down 15 percent compared to June of 2007.

Ozaukee County had 100 homes sold in June, up 63.9 percent compared to June of 2008, but still down 28.1 percent compared to June of 2007.

Washington County had 150 homes sold in June, up 12.8 percent compared to June of 2008, but down 10.7 percent compared to June of 2007.

Waukesha County had 417 homes sold in June, down 12.2 percent compared to June of 2008 and down 27.6 compared to June of 2007.

Walworth County posted a small home sale increase in June, while Racine and Kenosha counties saw declines. Home sales in Walworth County were up 0.9 percent, in Kenosha County was down 15.3 percent and in Racine County were down 5.5 percent.

With home inventory at almost 11 months (2.5 times larger than in 2004), sellers have to be extremely competitive in their pricing in order to sell. Only very serious sellers are able to sell (See blog spot of May 7, 2009 for further explanation). Sellers who are wise, use Homeowners Concept's low commission structure to sell so they can be more competitive.

Tuesday, July 7, 2009

Is it lazyness or incompetence?

We have run into the following situation before and brings to light that sellers get compromised despite paying a high commission of 5% or 6% (see blog post of 3/12/09 for a better understanding of why paying more commission gets you less expertise).

We have run into the following situation before and brings to light that sellers get compromised despite paying a high commission of 5% or 6% (see blog post of 3/12/09 for a better understanding of why paying more commission gets you less expertise).One of our agents is working with a buyer who decided to offer on the home at 165 N. 72nd st in Milwaukee (MLS# 1086805). As our Offer was being considered, another Offer by a different buyer came in. Evidently, the other Offer was better in price to the one our buyer submitted because seller signed off on the competing Offer.

We realize sellers do not know the proper way to maximize their selling price. This is where the listing agent, who seller is paying a high commission, either was lazy or incompetent in advising the seller to make a multiple counteroffer to both buyers. You see, our buyer was WILLING to go higher, had he be given the opportunity. By accepting the first offer, seller definitely left money on the table AND paid a high commission on top of that.

Because Homeowners Concept agents do 3-4 times more sales and have been in business for 12 years longer than the average agent, a seller can expect to net much more at closing (adding to the thousands in savings from paying just our low commission).

Tuesday, June 30, 2009

Low appraisals present a real disadvantage when paying 6%.

The National Association of Realtors recently reported that "In the past month, stories of appraisal problems have been snowballing from across the country with many contracts falling through at the last moment." Part of these deals are falling apart due to the cost of selling a property when one uses a traditional, high commission broker.

Just like when buyers decide on which home to make an offer on and for how much, appraisers decide the value of the property for the lender regardless of what the seller is paying in commission. Sellers and brokers have absolutely no control what the appraised value is going to be. If you plan to sell, BE WISE and determine from the start that paying a very low commission would only help to net you more money once the value is calculated by the appraiser (which may be less than what you have in mind).

Wednesday, June 24, 2009

Avoid agents that want to "buy the listing"

Tuesday, June 16, 2009

The 3 most important things a seller needs to do to sell fast and for top dollar.

What are the three most important things a seller should do to sell fast and for top dollar?

One: Price at or below the last comparable sale within a three to six month prior period. Take a look at the comparable sales in your area, find the sale that is closest to your property in scope, and list your property at or lower than what that property sold for. If you choose Homeowners Concept and pay just 1.5% commission, you can afford to price lower than the competition. Remember buyers could care less what you pay in commissions all they care for is the bottom line.

Two: Work with an agent who has a track record for selling many homes and has been in business a long time. All of the Homeowners Concept agents are carefully picked from many candidates and sell 3-4 times as many homes than the average agent and have 17+ years in business vs less than 5 yrs for the high commission agencies.

Three: Present your house in the best condition possible so potential buyers walk through the door and feel they could live there. Take the advice of a professional (again the Homeowners Concept is a great source of advice) in terms of what needs to be changed, removed, or added. In some cases, you might need a professional staging company to get the house ready for showings. After the property is ready, be sure to make it available for open houses and showings.

Wednesday, June 10, 2009

Now, may be the best time to buy.

Friday, June 5, 2009

Where is the advantage???

This property, just a few blocks from my home, at 1004 N. 70th st. Wauwatosa just sold for $329,000 BUT started at $409,900 9 months ago. This home was listed with the number one real estate company in the metro area and one of the top producers of this company. The home had dramatic reductions of $10,000, $40,000 and $30,000 respectively, before it got to a point where an offer was accepted. One has to wonder where the big company/big producer paying 6% or more commission advantage came into the picture (about $20K).

The high commission brokers have spent billions of dollars brainwashing sellers into thinking that there is an advantage spending thousands of dollars more in commissions. If one takes the time to investigate the data, one will see that there is absolutely NO advantage whatsoever. In all cases the hefty commission becomes a disadvantage as it reduces the net proceeds to the sellers. In many instances the hefty commission stands as an obstacle to the sale when sellers have limited equity or they do not want to walk away with less money after paying the big commission.

Sunday, May 31, 2009

Pressure to list with the wrong agent/company.

Saturday, May 23, 2009

The advantage of Homeowners Concept in a recent sale.

The advantage of having a low commission and a skilled Realtor are invaluable in this market. Here is a home at 13550 Wrayburn Rd in Elm Grove, WI that listed with us about 2 months ago that had been on the market for about 2.5 years with a number of different agents. Recently the home received some interest at the $359,900 price and an offer from a buyer represented by another Realtor. Primarily and due to the cost of the Realtor's commission of 2.4%, the offer was never accepted. After a few more days another buyer wrote an offer directly with the agent of this home, Kati Fonte. The agent skillfully negotiated an offer that was higher than the Realtors's offer AND sellers were paying just our low commission of 1.5%. Needless to say the offer was accepted.

The advantage of having a low commission and a skilled Realtor are invaluable in this market. Here is a home at 13550 Wrayburn Rd in Elm Grove, WI that listed with us about 2 months ago that had been on the market for about 2.5 years with a number of different agents. Recently the home received some interest at the $359,900 price and an offer from a buyer represented by another Realtor. Primarily and due to the cost of the Realtor's commission of 2.4%, the offer was never accepted. After a few more days another buyer wrote an offer directly with the agent of this home, Kati Fonte. The agent skillfully negotiated an offer that was higher than the Realtors's offer AND sellers were paying just our low commission of 1.5%. Needless to say the offer was accepted.It's a no brainer that commissions play a big role on whether an offer gets accepted by a seller. In the go-go years or 2003-2005 sellers had plenty of equity to waste on high commissions. Not anymore. It is crucial to choose a company that not only charges a low commission but brings a skilled Realtor to the table to make things happen.

Tuesday, May 19, 2009

More sellers now in tune with the market.

Homeowner Confidence Shrinks - Most Americans Now Believe Their Home’s Value Has Declined.

Almost four years into the decline in real estate prices the tables have turned and the majority (60%) now believe their home lost value during the past 12 months, according to Zillow's Q1 Homeowners Confidence Survey. Up until last year the majority believed their home had not declined in value. Over 80% of homes across the country lost value in the past 12 months, according to real estate market reports.

As for selling activity, it’s clear that a significant number of potential sellers are holding back due to the current market. When asked about future plans to sell, 31% of homeowners said they would be at least “somewhat likely” to put their homes on the market in the next 12 months if they saw signs of a real estate market turnaround.

“The perception of American homeowners is finally catching up to reality, which is that 80+% of all homes in the country lost value during this past year,” said Dr. Stan Humphries, Zillow’s vice president of data and analytics. “While homeowners are now more realistic when looking backward, they are still pretty starry-eyed when looking forward with three out of four homeowners believing that their own homes’ prices will increase or be flat over the next six months. Unfortunately, there are few markets we expect to perform this well.”

Humphries continued, “Also interesting is the information we have for the first time this quarter on the levels of ’shadow inventory’ - homes that people would like to sell but that aren’t currently on the market, and thus aren’t captured in the official number of homes on the market. With almost a third of homeowners poised to jump into the market at the first sign of stabilization, this could create a steady stream of new inventory adding to already record-high inventory levels, thus keeping downward pressure on home prices.”

Fortunately for sellers choosing to sell using Homeowners Concept's low commission structure, they can count on walking away with more money at closing than the competition.

Thursday, May 14, 2009

Tax credit can now be used for downpayment

This is great news and it is something I have personally been campaigning for since late 2008. You see, the biggest challenge for most home buyers is coming up with the cash needed to make a downpayment. The monthly payment is not usually the challenge, as that payment is similar to a rent payment for a comparable property. With this in mind, the Federal Housing Administration made a big decision and an announcement yesterday that will give first time home buyers some real help.

Shaun Donovan, secretary of the U.S. Department of Housing and Urban Development, said that the Federal Housing Administration (FHA) is going to permit its lenders to allow home buyers to use the $8,000 tax credit as a down payment. In a sense, the “no money down” days are back, except this time the home buyer will have equity in the property. Details about the tax credit can be viewed on the March 10, 2009 post or go to http://www.wisconsinhomebuyer.org/taxcredit.html

Tax Credit Can Be Used For Down Payment

The fact that FHA will allow this will make home ownership possible for a large number of first time buyers who just weren’t able to raise the funds necessary to buy. Believe it or not, this will help the entire market, not just the lower end of the market. Anything that helps remove the glut of homes on the market will be good for all home owners, including the move up market and higher end homes. The key to seeing home appreciation again in SE-WI is to reduce inventory to 6 months of supply or below from the current 11 months.

How To Use The Tax Credit As A Down Payment To Buy A House

Donovan, speaking at a Real Estate Summit, said “We all want to enable FHA consumers to access the tax credit funds when they close on their home loans so that the cash can be used as a downpayment.” In order to facilitate this, FHA’s approved lenders will be permitted to “monetize” the tax credit through short-term bridge loans. This will allow eligible home buyers to access the funds immediately at the time of purchase. For more information call our lender Netcentral Mortgage at 414-258-7833.

Tuesday, May 12, 2009

Court decision targets extra closing fees.

May 10, 2009

Thursday, May 7, 2009

Which seller are you?

Getting your home sold in SE-WI right now, is not as tough as you might think despite the market. The key is understanding a few things about yourself and how you approach the market that determines if and how quickly you sell.

What Home Buyers Want

Right now, there are roughly half the number of buyers in the market as we would normally see. As a general rule, they are conservative and concerned due to the state of the economy and tough lending requirements. They are looking for value. Ultimately, they are going to buy the home that is the best value on the day they make their purchase decision… Wouldn’t you if you were buying today?

Understanding The Housing Competition

Knowing that buyers are looking for value, another key factor if you want to sell a home is knowing who your true competition really is. For you to determine “good value,” you have to know what to compare with. This takes working with a real estate agent that understands the market better than the others. Choosing your initial market position is perhaps the most important factor when deciding to put your home on the market.

Your Motivation To Sell A Home.

So you know what buyers want and you understand your competition and how to value your home, the next and final step is to understand your current situation. Are you motivated enough to sell your home? Here’s a simple test:

Pick which of the below choices best describes you. Think seriously before you decide, as this will help you greatly.

- The Casual Seller - The casual seller says things like “We are not in a hurry,” or “We don’t want to give it away.” You can expect this person to say “We will sell if we can get $X ….”

- The Serious Seller - The serious seller says things like “I understand the market and I’m willing to sell my home for what I’m seeing out there.” This seller is ready to sell at “perceived market value” and they expect to price their home with the competition to get it sold.

- The Very Serious Seller - The very serious seller must sell now. They are willing to create a perception of value and entice buyers to select their home before all others.

Who will sell their home in the next few months?

So, what kind of a seller are you?

If you answered the above question as honestly as you could, you need to know that the casual seller is not going to sell their home in today’s market. There are just way too many homes for sale and the casual sellers are doing themselves and the very serious sellers a dis-service by adding to the inventory.

The market will eventually recover and there will again be great times to sell, but today’s buyer pool is looking for value. Even the serious seller is most likely not going to sell their home. With over 11 months of supply in SE-WI plus new short sales and foreclosures entering the market, only the very serious sellers have the best chance of being successful over the next 12 months. Luckily with our very low commission of 1.5% a seller listing with Homeowners Concept has quite a few thousands of dollars in savings to play with. A serious seller can take the savings and deduct it from the list price making their home much more attractive to buyers.

Monday, May 4, 2009

Some make wrong choices, repeatedly.

This property has been on the market for over 550 days and was with two different agents in addition to the limited service brokers but at much higher price than currently on the market. They probably never received the proper advice on pricing, presentation and staging necessary to get the job done at a reasonable time frame. The choice of agents employed by the sellers of this property was without much research as they both do very few closings/year and consequently have nowhere the capabilities of our average agent.

In the current real estate market, sellers need to be judicious on using the best agents in the metro area. A little research would show that we offer not only highly skilled agents but we charge much less than a 5, 6 or 7% agency.

Thursday, April 23, 2009

Selling/buying in this market

The market peaked in the Spring of 2005. The years prior to 2005 were marked by a run up in home values like we had never seen before. There were years during this time where property values increased by over 10% year to year. These values were not sustainable as incomes failed to keep pace.

In a survey of Realtors by Homegain in March, 2009 showed that 45% of homeowners think their homes should be listed 10 to 20 percent higher than what their Realtors recommend. Nearly 20 percent of homeowners think that their homes are worth 20 percent higher than their agents recommended listing price. Home buyers are experiencing a similar disconnect on price. According to the Realtors surveyed by HomeGain, only 18 percent of their home buying clients think homes are fairly priced.

This survey underscores that while homesellers may be aware of falling home prices around the country, many believe that the slide doesn't apply to their homes. Many sellers have decided to take their homes off the market or not list at all because they want to wait "till the market comes back". There is a belief by many sellers that the market is going to come back very soon. Unfortunately many sellers are putting off their plans to move on with their life hoping that the market will make a dramatic "V shaped" recovery which has never happened before.

A fascinating thing about the decision process is a sellers unwillingness to part with the lost equity on their current home, even though they will be turning around and purchasing another home under the same conditions. Furthermore, everyone accepts losses in other assets such as the stock market, collectibles and cars but most people find it hard to take a loss in the value of real estate. We constantly witness sellers getting hung up on getting X amount out of their home that they continue to "feed" even a vacant property by paying each month taxes, mortgage, maintenance, etc. You can now find 100s of properties that have been on the market for over 2 years, many of them vacant (not foreclosures).

Most economists predict that once we do finally hit bottom we will only see a more historical norm of 2-3% yearly appreciation on our homes. Do the math - with this kind of reality check it is very easy to see why it is going to take a long time to get to the levels were at prior to the Real Estate correction.

Some food for thought. As of this writing interest rates are outstanding under 5%. If you have wanted to sell your home for whatever reason and are not because you don't want to lose the equity you once had then you could be making a huge mistake. Interest rates are at a once in a life time level. When the economy does finally improve interest rates this low will not last.

It could be 5-7 years or longer before we get back to the levels of 2005. What are the chances that interest rates will be where they are now when that finally happens? When your home finally does get back to 2005 levels so will all the other homes in the area.

Thursday, April 16, 2009

Flat Fee is out. Reasons why:

Homeowners Concept on the other hand is a full service real estate company which offers more marketing, more experience for less commission due to innovative and efficient systems and has been around since 1984. We have also earned the Accredited Business BBB award - one of only two large companies to have this! We have a vested interest in making sure the home gets maximum exposure (percentage wise we spend the most amount of money advertising properties of any company). We actually work very hard for the money.

So many of these flat fee outfits have come to the market the last few years (as of this writing we can find at least 11 in SE-WI) because it is such easy money for little work with no pressure to sell the homes. The proliferation of these is reminiscent of the online FSBO websites that were started as internet became mainstream. Hundreds of them have shut down in recent years as consumers wised up that spending hundreds of dollars upfront to be on "somebody's" website that received virtually no hits, was indeed useless. We feel the same fate awaits the MLS only/limited service companies.

Tuesday, April 7, 2009

Extremely High Success Rate.

This small number of sellers who refuse to face reality sometimes migrate to a high commission agency under the perception that by paying much more in commission a buyer will come along and pay "their price". Reality though is, that buyers DO NOT care how much commission one pays. One can see this by the previous post that sellers find this out the hard way, wasting many more months on the market, then reducing (sometimes multiple times) and paying a high commission at the end. Not a smart move by any means.

In previous years sellers could ask more than the market because as prices rose those sellers would eventually get "their price". Nowadays though the market is stagnant, if a seller wants a higher price than the market analysis by one of our expert agents suggests, or showings and feedback from buyers indicates too high of a price, the property sits. All real estate companies face the same problem with sellers in denial (see article Milwaukee Journal Home section of 3/15/09 ).

With our very low commission structure, sellers have a clear advantage over sellers with a high commission broker because they can afford to lower the price if they want to sell. For an average metro-Milwaukee home of $209,000 the savings between a 6% and our 1.5% commission amounts to $9,400. So if a buyer is looking at two identical properties one at $209,000 the other at $199,600 you know which one is going to get more showings and eventually an Offer. Of course there is rarely identical properties due to so many variables (location, condition, decorating, etc). This is the area where our expertise comes into play. Given the exposure and expertise we offer, there is no way a property cannot sell under our program. Hence the statement above.

Wednesday, April 1, 2009

Some Sellers Pay Much More Commission, Unnecessarily

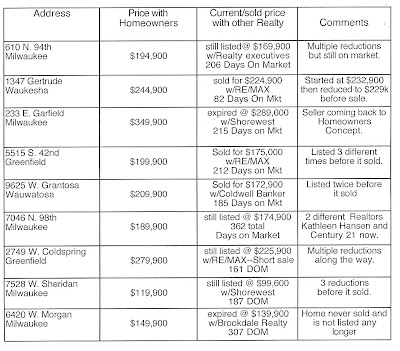

Paying a high commission of 5, 6 or 7% gives no advantage whatsoever to a seller as the table indicates.

Paying a high commission of 5, 6 or 7% gives no advantage whatsoever to a seller as the table indicates.This is a list of sellers and their properties that have left Homeowners Concept in last year and the price that they are currently on the market or sold for with another realty paying FAR MORE in commissions and getting less marketing for the homes (As of 4/1/09).

Evidently a few sellers have the perception that paying more will get the home sold and sold at the price they want. The fact is that buyers could care less how much commission one is paying. Actually by having to pay much less commission a seller could get the home sold by offering a better price to the buyer (see blog post of 2/26/09 for an actual case).

Monday, March 30, 2009

Administrative fee of $595 charged on top of 6%

Today we closed on a property whereby we brought the buyer to the table. The listing office is the third largest company in town and they were charging the seller a $595 administrative fee. So even though homes prices are under pressure, some high commission brokers are raising their end fee to even higher level than it should be. It is unbelievable how much sellers get squeezed by the high commission brokers.

Wednesday, March 25, 2009

Thinking Limited Service? Think again.

This price cut had spurred some activity but she was wondering whether other Realtors were avoiding the home or talking buyers out of it because it was limited service. This issue has been raised many times by sellers, ever since the MLS only companies came into the market a few years ago. Yet, you will not find an agent admitting such but as our study of the local market showed (see the blog post dated 2/20/09 titled: MLS only companies - an eye opener) many sellers who pay all this money upfront have little success. The companies (known in the industry as "list them and forget them") collect their money upfront (around $500) and have no incentive to sell the home. There is definitely more work for an agent that decides to show and write on a limited service home because the seller is still For Sale By Owner and there is no other agent to assist the seller with the contracts, counters, inspection, closing, etc. As a result this work falls on the shoulders of the selling agent. So putting yourself in an agent's shoes having to choose from a vast selection of homes and looking at the dismal success rates Dana's observation is right on the money.

Thursday, March 19, 2009

Rates under 5%, market starting to heat up!!!

As was anticipated, with the Fed action yesterday, the rates took a dramatic drop to the 4.5% range (for exact rates click here: http://www.netcentralmortgage.com/pages/rates.html ). Rates were as low as 4 3/8 for a 15 year mortgage today. Expert say though that this may be the bottom in interest rates because there are fewer lenders in the marketplace now (see Wall Street article -3/20/09)

With the vast selection of properties on the market, the $8,000 tax credit for first time homebuyers and now the even lower rates, many smart buyers are using this opportunity to step up to the plate and buy. In the past 2 days alone we had eleven offers accepted. A number of buyers that were fence sitting are setting up appointments to view properties in the next few days.

If you are in the market to buy, call the central office at 414-258-7778 and we will direct you to one of our very experienced agents that specializes in the area you are looking